You set up your account with Mint, then link all of your financial accounts. The most important function of Mint is budgeting, and it is especially good in that department. So, how do the two companies measure up? Mint A large part of that, of course, is proper budgeting. The purpose of these two management systems is to keep track of your money and help you spend it wisely.

Both provide you with all of the tools and features available on the platform, however, the premium version offers active investment management.Ĭheck It Out: Our Review of Personal Capital Personal Capital vs.

#Quicken mint personal capital blog review 2017 free

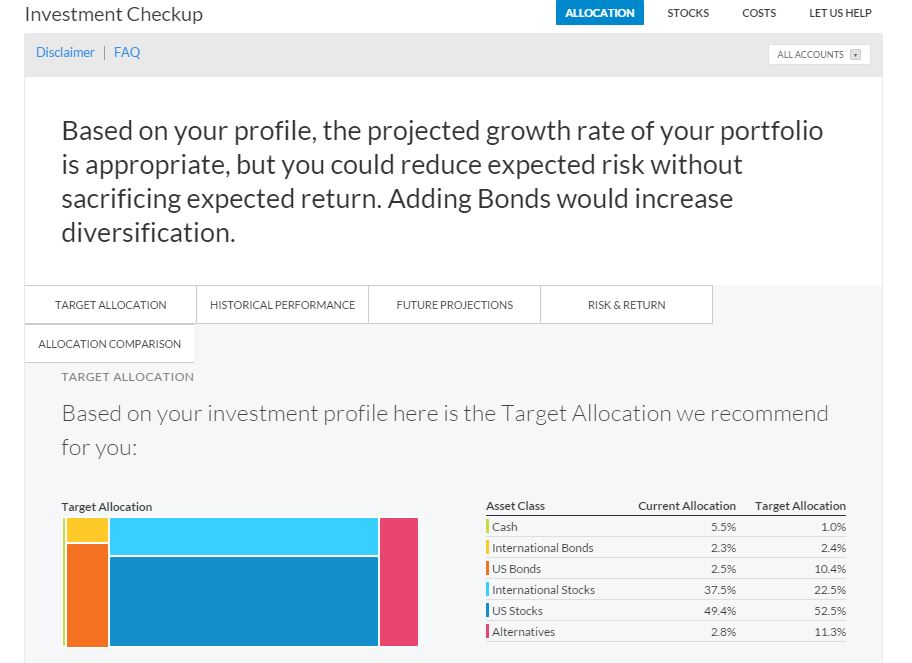

Personal Capital offers both a free version and a premium version. That enables Personal Capital to act as an all-in-one financial management platform. But they also act as a financial aggregator, enabling you to link all of your financial accounts in much the same way that Mint does. They have an advisory team that can manage all aspects of your investments. Personal Capital has budgeting capabilities, but it’s primarily an investment service. And perhaps best of all, the application is completely free to use. The application enables you to manage virtually all aspects of your finances. Mint is one of the most popular budgeting applications available and is part of the TurboTax and Quicken families. Mint enables you to look at your entire financial situation holistically, rather than in bits and pieces. That includes your checking, savings, credit cards, investments, retirement accounts, and even your PayPal account. It pulls your entire financial life into one application. Mint is an online personal budgeting platform. Which you will prefer to work with will depend entirely on what you are looking for the platform to do. While there are some similarities, the differences between the two render them very different services. Mint and Personal Capital are two web-based, money management platforms that are frequently compared to one another. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below. We may, however, receive compensation from the issuers of some products mentioned in this article. You can trust the integrity of our balanced, independent financial advice.

0 kommentar(er)

0 kommentar(er)